European renewable energy policy*

GIOVANNI RIVA♦ - MAURO ALBERTI◊

Abstract

The European Union

(EU) was one of the strongest proponents of the Kyoto Protocol for reduction of

greenhouse gases emissions, and assumed, for the first commitment period,

2008-2012, an emission reduction obligation of 8 % (below the 1990 level).

European Union's strategy to reach greenhouse emission reductions in energy

sector, one of the most significant for Kyoto compliance, relies on three major

pillars: (1) more efficient use of energy, especially as regards end uses, (2)

increased utilization of renewable energy, and (3) accelerated development and

deployment of new energy technologies – particularly next-generation fossil fuel

technologies that produce near-zero harmful emissions (e.g. by means of CO2

sequestration techniques).

Biomass constitutes the main renewable energy source on which European States

may rely to fulfil their targets of green energy consumption and green

electricity generation. Several studies have thus been conducted in the last

years to evaluate the potential of energy generation from biomass. For Western

Europe (‘‘OECD Europe’’) the potential contribution of primary biomass to energy

demand could be from 10 to 20 %.

European policy and associated legislation issued to effectively promote

renewables and biomass development is based on several mechanisms that, taken

altogether, can foster the comprehension of renewable technologies, the

spreading of knowledge about renewable energy and the realization of projects.

Keywords: energy policy, renewable energy, biomass, incentives.

1 INTRODUCTION

Energy policy came to the forefront in Europe with the oil crisis of the

1970s. Before then, governments had largely invested in electrification and had

created large integrated monopolies that generated, transmitted and distributed

electricity.

In most countries in Western Europe governments were primarily engaged in

nuclear power development. In some countries governments also involved

themselves in the supply of oil, coal and/or natural gas. Renewable energy

sources, with the exception of hydropower in countries having significant

hydropower potential (e.g. Italy, Sweden, etc.), attracted very little interest.

In the last thirty years the situation has changed. Nowadays, there are

considerable concerns in Europe over security of energy supply, environmental

issues, competitiveness of the European economies, and regional development.

Imports of oil and natural gas are expected to grow from, respectively, 80 % and

46 % of total consumption in 2000 to 93 % and 73 %, respectively, in 2020 [DG

TREN, 2003]1. Increased use of energy carriers produced from domestic,

renewable flows of energy is one way to reduce import dependence. The other

major option is to increase the efficiencies of energy and material use [Jochem

et al., 2002].

Support for renewable energy technology development has also been seen as a way

to build a competitive industry that will have a global market, as alternatives

to conventional energy sources are increasingly sought. For example, development

at regional and local level could be supported by the use of land-intensive

renewables, primarily biomass.

The European Union (EU) was one of the strongest proponents of the Kyoto

Protocol for reduction of greenhouse gases emissions, and assumed, for the first

commitment period, 2008-2012, an emission reduction obligation of 8 % (below the

1990 level). Although this represents a significant first step, much deeper

global emission reductions would have to follow to achieve the objective of the

United Nations Framework Convention on Climate Change (UNFCCC)2. To

achieve the first commitments, the EU member states have shared the

responsibilities between member states in the so-called European bubble3.

European Union's strategy to reach greenhouse emission reductions in energy

sector, one of the most significant for Kyoto compliance, relies on three major

pillars: (1) more efficient use of energy, especially as regards end uses, (2)

increased utilization of renewable energy, and (3) accelerated development and

deployment of new energy technologies – particularly next-generation fossil fuel

technologies that produce near-zero harmful emissions (e.g. by means of CO2

sequestration techniques).

Increased use of renewable energy is thus deemed as extremely important to

reduce dependence on extra-UE energy sources as well as reduce the environmental

challenges European Union is facing. Another important target is the development

of an industrial (for technologies and infrastructures creation) and service (for

energy production and distribution) sector which could contribute to make EU

economy grow in the future4.

2 EU RENEWABLE ENERGY POLICIES

2.1 Energy situation in the European Union

Primary energy consumption in the EU-15 was 62.8 EJ (1500 million tonnes of

oil equivalent, Mtoe) in 2001.

Contributions from different sources for 1990 and 2000 are shown in Table 1,

together with projections in a baseline scenario to 2030. Electricity generation

was 2600 TWh in 2000 and is, in this scenario, projected to grow to 3800 TWh in

2030.

In the baseline scenario for the EU-15, presented by DG TREN [2003], population

is expected to grow from 379 million in 2000 to 389 million in 2030, remaining,

thus, essentially stable. Gross domestic product (GDP) is projected to grow from

8.545 trillion euros in 2000 to 16.920 trillion euros in 2030, corresponding to

an average growth rate of 2.3 % per year. The energy intensity is projected to

decline from 7.1 to 4.3 PJ per million (M) euros in the same period. The

contribution of renewables would remain below 10 %, missing the target set by

the EU. Estimates of International Energy Agency (IEA, World Energy Outlook

2002) for EU are more conservative as regards GDP, projected to reach 14.689

trillion euros in 2030 (average growth rate of 1.9% per year), and also as

regards decline of energy intensity, which is deemed to be around 5 PJ per

million (M) euros in 2030. The result is, thus, roughly the same as regards

primary energy demand projected for 2030, i.e. about 72 EJ in DG TREN estimates

and 74-75 EJ in IEA estimates5.

Table 1: Gross inland energy consumption (in EJ) in the European Union (EU-15),

and projected consumption in the baseline scenario (DG TREN 2003).

|

|

1990 |

2000 |

2010 |

2020 |

2030 |

|

Solids |

12.69 |

8.88 |

6.99 |

7.54 |

9.34 |

|

Oil |

22.86 |

24.58 |

25.00 |

25.42 |

25.33 |

|

Natural gas |

9.30 |

14.19 |

19.09 |

22.19 |

23.28 |

|

Nuclear |

7.58 |

9.34 |

9.63 |

8.33 |

7.54 |

|

Electricity |

0.08 |

0.17 |

0.13 |

0.13 |

0.13 |

|

Renewables |

2.76 |

3.68 |

5.11 |

5.82 |

6.45 |

|

Total |

55.31 |

60.84 |

65.99 |

69.38 |

72.02 |

|

of which |

|

|

|

|

|

|

Hydro |

0.93 |

1.16 |

1.18 |

1.24 |

1.26 |

|

Biomass |

1.24 |

1.51 |

2.14 |

2.45 |

2.75 |

|

Waste |

0.50 |

0.78 |

1.2 |

1.10 |

1.06 |

|

Wind |

0.004 |

0.08 |

0.56 |

0.76 |

0.99 |

|

Solar and others |

0.004 |

0.013 |

0.06 |

0.10 |

0.19 |

|

Geothermal |

0.09 |

0.138 |

0.16 |

0.17 |

0.20 |

|

Total renewables |

2.76 |

3.68 |

5.11 |

5.82 |

6.45 |

|

Renewables as % of totale inland consumption |

5.0 |

6.1 |

7.8 |

8.4 |

8.9 |

The Renewable Energy White Paper (EU, 1997), indeed, stated that indigenous

renewable sources of energy would have to play an important role in improving

energy supply security. It set an indicative target of 12% for the share of

renewables in the EU’s primary energy portfolio in year 2010, more than double

this share in 19956.

Renewables exploitation is required to reduce dependence on oil and natural gas.

The supply of gas in Europe risks creating a new situation of dependence7.

Geographic gas import diversification is presently quite poor with Russia and

Algeria accounting for 41% and almost 30% of the EU’s natural gas imports. A

number of Member States, and in particular most new member countries, are

entirely dependent on a single gas pipeline that links them to a single supplier

country.

2.2 Renewable Energy Policies

After a delicate negotiation process, EU renewable8 energy

policy-making culminated in the adoption of two renewables-specific directives.

The first [EU, 20019] provides a Union framework for the promotion of

electricity from renewable sources, while the second [EU, 200310]

addresses the promotion of biofuels and other renewable (automotive) fuels. We

will refer to these directives in what follows as the RES-E Directive and the RF

Directive11 respectively.

On the other hand, there is no regulatory framework yet to accelerate the growth

of the market for RES heating and cooling. However, the development of such a

framework may build on the foundations laid by the Directive on the Energy

Performance of Buildings [EU, 200212] and the Directive on the

Promotion of Co-generation of Useful Heat and Electricity [EU, 200413].

European policy and associated legislation issued to effectively promote

renewables development is based on several mechanisms that, taken altogether,

can foster the comprehension of renewable technologies, the spreading of

knowledge about renewable energy and the realization of projects. Among these

mechanisms, the most important, which are considered in all of the

above-mentioned directives, are the following:

- economic incentives (e.g. feed-in tariffs, quota obligations - i.e. green

certificates, tendering/bidding schemes, investment subsidies and fiscal

measures);

- promotion of research activity on innovative technologies (e.g. gasification

technology for biomass)

- definition of clear and effective planning procedures for renewable plants

siting (e.g. guidelines for regional/local planning);

- communication of the value of green energy to users (e.g. guarantee of origin

for renewable electricity).

Although an effective development of renewables sector must derive from the

combination of all the above-mentioned factors, economic incentives constitute,

needless to say, the main assistance that renewable energies must be given to

become competitive with respect to conventional energies.

Substantial cost reductions in the past few decades in combination with adoption

of subsidies by Member States' governments have made a number of renewable

energy technologies (RETs) competitive with fossil-fuel technologies in specific

applications14 (Table 2).

Table 2: Comparison of costs for electricity generation, Conventional vs.

renewable technologies. Source: Macchi-Chiesa-Bregani, 2003.

|

|

|

Installation cost

|

Capital recovery factor

|

Availability |

Fuel costs |

O&M (two components: electricity dependent and capacity dependent) |

Electricity costs |

|

| η | euro/kW | Hours/yr | Euro/kWh | euro/kWh | euro/kW-yr | euro/kWh | ||

|

Coal (Ultra Super Critical) cycles |

0,435 |

1.100 |

0,150 |

7.250 |

~ 0,01 (1) |

0,0045 |

18 |

~ 0,04 |

|

Repowering combined cycle |

0,555 |

350 |

0,150 |

8.000 |

~ 0,025 (1) |

0,0025 |

9 |

~ 0,035 |

|

New combined cycle |

0,565 |

430 |

0,150 |

8.000 |

~ 0,025 (1) |

0,0025 |

9 |

~ 0,036 |

|

Cogeneration natural gas |

0,605 |

500 |

0,150 |

6.000 |

~ 0,023 (1) |

0,0055 |

7 |

~ 0,031 |

|

Wind generator |

- |

1.000 |

0,150 |

2.000-2.500 |

- |

- |

88 |

0,07-0,10 |

|

Biomass |

0,25 |

2.000 |

0,150 |

7.000 |

0,01 - 0,06 (2) |

0,0045 |

10-15 |

0,01 - 0,12 |

|

Nuclear |

- |

2.000 |

0,133 |

8.000 |

~ 0,004 |

0,0080 |

32 |

~ 0,05 |

|

(1) Price

for carbon and natural gas is assumed respectively as 1.37 and 3.90

euro/GJ LHV (natural gas 0,14 euro/Nm3) |

||||||||

Economic incentives established by national governments, however, have to comply

with European Union market-based approach for industrial and service activities.

In the case of renewable energies, a level playing-field for European renewable

energy suppliers has been regarded as essential to foster a swift market-based

penetration of intra-Union renewable sources of energy in the EU. This was

ensured by a Union-wide regulatory framework on state aid.

In 2001 the European Commission adopted an amended set of Union guidelines for

assessing whether aid administered by member states for environmental protection

is or is not compatible with the common market [EU, 2001]15. The

guiding principle in assessing aid for renewable energy, contained in the

Community Guidelines on State Aid for Environmental Protection, is that the

beneficial effects of such measures on the environment must outweigh the

distorting effects on competition [Point 5]16.

However, state aid for renewables should result in an overall increase of

renewable energy sources and not in shifts from one renewable energy technology

to another or from one member state with less favourable renewable energy

incentives to another with more favourable state aid in place for renewable

energy sources.

3 EU BIOMASS POLICY

As recalled in previous paragraphs, biomass constitutes the main renewable

energy source on which European States may rely to fulfil their targets of green

energy consumption and green electricity generation.

Biomass, however, must be clearly classified according to sector of derivation

and type of materials concerned. A correct classification is extremely important

because different types of biomass have diverse characteristics that determine

the cost of supply and other management and logistics aspects, as well as the

real availability of these materials as fuels. A simple classification is

presented in Table 3.

Table 3: Classification of biomass types and resources.

|

Supply sector |

Type |

Example |

Utilisation sector |

|

Agriculture |

Dry lignocellulosic agricultural residues |

Straw |

Tradeable, electricity and heat |

|

Dry lignocellulosic energy crops |

Short-rotation wood, miscanthus |

Tradeable, electricity and heat |

|

|

Livestock waste |

Manure |

Non-tradeable, waste |

|

|

Oil, sugar and starch energy crops |

Oil seeds for methylesters |

Tradeable, transportation |

|

|

Sugar/starch crops for ethanol |

Tradeable, transportation |

||

|

Forestry |

Forestry byproducts |

Wood blocks, wood chips from thinnings |

Tradeable, electricity and heat |

|

Industry |

Industrial residues |

Industrial waste wood |

Tradeable, electricity and heat |

|

Fibrous vegetable waste from virgin pulp production and from production of paper from pulp, including black liquor |

Non-tradeable, waste |

||

|

Wet cellulosic industrial residues and slaughter house waste |

---- |

||

|

Industrial products |

Pellets, bio-oil (pyrolysis oil), ethanol, biodiesel |

Tradeable, electricity and heat, transportation |

|

|

Waste |

Parks and gardens |

Prunings, grass |

Tradeable, electricity and heat |

|

Contaminated waste |

Demolition wood |

Non-tradeable, waste |

|

|

Biodegradable municipal waste |

Non-tradeable, waste |

||

|

Biodegradable landfilled waste, landfill gas |

Non-tradeable, waste |

||

|

Sewage sludge |

Non-tradeable, waste |

To understand biomass (and, more in general, renewable energies) potential, the

following definitions are considered:

- Theoretical potential: determined by energy flow.

- Technical potential: determined by technical constraints.

- Realistic potential: determined by non-technological factors/constraints.

- Realisable potential at a certain point in time: takes into account maximum

market growth rates over all countries.

Every step results in a reduction of the potential, due to various constraints.

This is illustrated in Figure 1.

Several studies have been conducted in the last years to evaluate the potential

of energy generation from biomass.

Taking into account geographical and land-use conditions as well as technical

and economic concerns, Hoogwijk [2004] investigated the global and regional

potential of biomass, wind and solar PV energy. The results on biomass are shown

in Table 4. For Western Europe (‘‘OECD Europe’’) the figure ranges from

10 to 20 %, and for Eastern Europe from 30 to 50 %.

For other regions in the world, notably Oceania, the former USSR, Canada, South

America and East Africa, much higher ratios (above 1) are found, indicating that

in the longer term most of the biomass used in Europe might originate from these

regions.

| Theoretical potential | |

| ↓ |

← Technical feasibility |

| Technical potential |

← Land Availability |

| ↓ |

← Acceptability & planning |

| Realistic potential |

|

| ↓ |

← World-wide industry production rate |

| Realisable potential |

|

Figure 1: Methodology for definition of potentials

Table 4: Potential future contribution of primary biomass to world

energy consumption and consumption in Western and Eastern Europe

|

|

Waste and residues in

2020-2050 |

Energy crops in

2050 (EJ/yr)[2] |

|||

|

|

|

below |

below 2 $/GJ |

below 4 $/GJ |

Total geographical potential |

|

Western Europe[4] |

NA[3] |

0 |

3-6 |

9-15 |

9-16 |

|

Eastern Europe[5] |

NA[3] |

0 |

6-8 |

6-9 |

8-9 |

|

Total world |

30-90 |

8-16 |

129-272 |

177-438 |

302-675 |

[1] Estimates from literature; the figures include forest

and crop residues, in some studies also animal and municipal solid wastes.

[2] Assuming different scenarios on land use following the marker scenarios A1,

A2, B1 and B2 of Nakicenovic et al., [2000].

[3] No figure available.

[4] Includes Andorra, Austria, Denmark, Faroe Islands, Finland, France, Germany,

Gibraltar, Greece, Holy See, Iceland, Ireland, Italy, Liechtenstein, Luxembourg,

Malta, Monaco, Netherlands, Norway, Portugal, San Marino, Spain, Sweden,

Switzerland, and United Kingdom.

[5] Includes Albania, Bosnia-Herzegovina, Bulgaria, Croatia, Czech Republic,

Hungary, Macedonia, Poland, Romania, Slovakia, Slovenia, and Yugoslavia.

Some six years have lapsed since the publication of the White Paper. Recent

RES-energy supply trends suggest that the White Paper indicative target of 12%

RES contribution to total primary energy supply in the EU by year 2010 will most

likely be under-achieved by a big margin.

Hitherto, with the notable positive exceptions of foremost wind energy and

possibly also – if certainly to a lesser extent - geothermal, most renewable

energy branches cannot live up to the high ambition level enunciated in the

White Paper. The White Paper projections for year 2010 suggest that, among other

renewables, biomass would contribute the lion’s share, 5.65 EJ or 8.5%, to total

primary energy supply.

For this to happen, biomass energy supply would have to increase by 3.77 EJ over

year 1995’s level. The White Paper provides the following elaboration for this

increment:

- Biogas (methane gas obtained by anaerobic digestion of livestock manure,

agro-industrial effluents, sewage treatment, landfills) →

0.63 EJ.

- Solid fuels (wood and agricultural residues) →

1.26 EJ.

- Energy crops dedicated to biofuels production (rape seed, sugar beet, etc.)

→ 0.75 EJ.

- Solid cellulosic energy crops (short rotation forestry, miscanthus, etc.) for

heat and/or power → 1.13 EJ.

Recent trends suggest the following. The biogas ‘target’ will not be met, mainly

because of a phasing out of landfills, subsequent to recently introduced EU

legislation fostering waste incineration.

Biogas production used for heat or electricity stood at 0.01 EJ (2304 ktoe) in

2000. The UK, a country with as yet a fair amount of landfills, is the leading

country in the EU.

The EU’s odd 100 million hectares of forested area yielded 1.98 EJ (47.3 Mtoe)

of primary solid biomass energy in year 2000. EurObserv’ER (EurObserv’ER, 2002)

deems 2.60 EJ (62 Mtoe) in 2010 achievable, an amount possibly on the optimistic

side. Yet it is far below the 4.19 EJ (100 Mtoe) needed for meeting the White

Paper target.

The White Paper expectations of biofuels will not be met in spite of the adopted

Renewable Fuels Directive (above mentioned). Production in 2000 stood at 0.03 EJ

(191 kt ethanol and 700.6 kt biodiesel). The indicative target of the recently

adopted Renewable Fuels Directive boils down to 0.73 EJ (17.48 Mtoe), comparable

to the White Paper projection of 0.75 EJ (18 Mtoe). As a result, all indications

suggest that biomass is set to lag behind the White Paper projections by a

considerable margin.

3.1 Incentive schemes

The policy instruments that are in place in the different Member States to

promote generation of electricity from renewable sources (and, then, biomass)

are all based on two main principles. The instruments either affects the supply

or the demand of renewable electricity, and the focus either on the production

of electricity or on the installed capacity of renewable electricity plants (see

Figure 2)

|

|

Generation based (kWh) |

|

|

|

Supply side |

Feed-in tariffs |

Quota obligations/

green certificates |

Demand side |

|

Investment subsidies |

(Quota obligations) |

||

|

|

Capacity based (kW) |

|

|

Figure 2: Classification of incentive schemes.

Within this categorisation, there are basically three main

instruments to promote renewable electricity. These instruments are feed-in

tariffs, quota obligations in combination with a green certificate system, and

tendering/bidding schemes. Besides the three main instruments there are

complementary mechanisms possible, like investment subsidies and fiscal measures.

Feed-in tariffs

Feed-in tariffs are a commonly used policy instrument for the promotion

of renewable electricity production. The term feed-in tariff is used both for a

regulatory, minimum guaranteed price per unit of produced electricity to be paid

to the producer, as well as for a premium in addition to market electricity

prices. Regulatory measures are usually applied to impose an obligation on

electricity utilities to pay the (independent) power producer a price as

specified by the government. The tariff may be supplemented with subsidies from

the state. The level of the tariff is commonly set for a number of years to give

investors security on income for a substantial part of the project lifetime.

Many different adaptations of the instrument are applied.

A feed-in tariff can be based on the avoided cost of the utility that has the

purchase obligation, or on the end price to the consumer. However, the level of

the tariff need not have any direct relation with either cost or price, but can

be chosen at a level to motivate investors for green power production.

Quota obligations/green certificates

Quota obligations are used to impose a minimum production or consumption

of electricity from renewable energy sources. The government sets the framework

within which the market has to produce, sell, or distribute a certain amount of

energy from renewable sources. The obligation is imposed on consumption (often

through distribution companies) or production. Governments may choose to

establish 'technology bands' in order to protect technologies from strong

competition by lower cost options. The quota can usually be traded between

companies to avoid market distortions. A tradable green certificate is needed

for this system. These green certificates provide an accounting system to

register production, authenticate the source of electricity, and to verify

whether demand has been met.

Bidding systems

Bidding procedures can be used to select beneficiaries for investment

support or production support (such as through feed-in-tariffs), or for other

limited rights- such as sites for wind energy. Potential investors or producers

have to compete through a competitive bidding system. The criteria for the

evaluation of the bids are set before each bidding round. The government decides

on the desired level of electricity from each of the renewable sources, their

growth rate over time, and the level of long-term price security offered to

producers over time. The bidding is accompanied by an obligation on the part of

electricity providers to purchase a certain amount of electricity from renewable

sources at a premium price. The difference between the premium and market price

is reimbursed to the electricity provider, and is financed through a

non-discriminatory levy on all domestic electricity consumption. In each bidding

round the most cost-effective offers will be selected to receive the subsidy.

The mechanism therefore leads to the lowest cost options.

Investment subsidies

Investment subsidies can help to overcome the barrier of a high initial

investment. This type of subsidy is commonly used to stimulate investments in

less economical renewable energy technologies. Investment subsidies are usually

20-50% of eligible investment costs, but in some cases subsidy is given over the

total eligible investment sum, however within the limitations of the Community

guidelines on State aid for environmental protection. Loans with a low interest

rate can also be considered as investment subsidies.

Fiscal measures

Some EU countries support renewable electricity by means of the fiscal

system. These schemes may take different forms, which range from rebates on

general energy taxes, rebates from special emission taxes, proposals for lower

VAT rates, tax exemption for green funds, to fiscal attractive depreciation

schemes, which must be in line with the Community guidelines on State aid for

environmental protection.

It must be said that all of these mechanisms are permitted within the contest of

the Renewable Electricity Directive17.

Feed-in tariffs are permitted provided that it is demonstrated (as it has been

the case for German Law on Renewable Electricity) that they are correctly

defined to favour development of renewable technologies without excessive state

aid and they are progressively modified (i.e. reduced) to take into account

renewable technologies improvement and cost reductions.

In recent years, however, several EU Member States have assessed the possibility

of introducing a green certificates mechanism18. Member States choices are

presented in Table 5.

Table 5:EU countries with feed-in tariffs or quota systems (green

certificates) in December 2004. Sources: Bechberger et al. 2003; Reiche 2003;

Reiche 2002; www.aroges.org

|

Country |

Feed-in tariff |

Quota obligation + certificate trading |

Biomass incentive (cent€/kWh) |

||

|

Austria |

● |

|

Solid biomass and waste with large biogenic fraction: 10.2-

16.0 € cents /kWh (10-2

MW), 6.5 € cents /kWh (hybrid plants)

MW) 4.0-5.0 € cents /kWh

(hybrid plants)

€ cents /kWh |

||

|

Belgium |

●1 |

● |

Biomass and other RE: 2 € cents/kWh (Certificate minimum price) |

||

|

Cyprus |

● |

|

Biomass, landfill and sewage: 6,3 € cents/kWh |

||

|

Czech Republic |

● |

|

Biomass and biogas: 8 € cents/kWh (year 2003) |

||

|

Denmark |

● |

○ |

Solid Biomass: A settlement price of 4 € cents/kWh is guaranteed for a period of ten years. Additionally and as a guarantee these plants receive 1 € cent/kWh in compensation

for an RE certificate. |

||

|

Estonia |

● |

|

Electricity price for renewable energy 1.8 times the residential price, so the price for renewable energy is: 5,2 € cents /kWh. This price is paid for 7 years for biomass. |

||

|

Finland |

● |

|

Biomass: 4,2 € cents /kWh |

||

|

France |

● |

|

Biomass: Standard rate of 4,9 € cents/kWh, premium up to 6 €

cents/kWh

premium up to 6 € cents/kWh

cents /kWh for 15 or 20 years. A tendering system is in place for renewable energy installations > 12 MW. |

||

|

Germany |

● |

|

Biomass: up to 500 kW: 10 € cents/kWh, up to 5 MWp: 9 €

cents/kWh, up to 20 MWp:

8,6 € cents/kWh, form 501 kW to 5 MW: 6,6 € cents/kWh |

||

|

Greece |

● |

|

Feed-in tariff of about 7,8 € cents/kWh on the islands and 7 € cents/kWh on the mainland |

||

|

Hungary |

● |

|

Energy generated from renewable energy resources must be purchased between 6 and 6,8 € cents/kWh |

||

|

Ireland |

Tendering scheme |

|

Target purchase

prices |

||

|

Italy |

|

● 2 |

Certificate prices up to 9.74 €ct/kWh, 2004. (Certificates are issued only for plants producing more than 50 MWh per year.) |

||

|

Latvia |

● |

|

The annual purchase tariff for small hydro power as well as for power plants using waste or biogas is set at the average electricity sales tariff. |

||

|

Lithuania |

● |

|

Average energy

prices since February 2002: |

||

|

Luxembourg |

● |

|

Biomass, biogas: 2.5 up to 3 MW, 10 years |

||

|

Malta |

|

|

--- |

||

|

Netherlands |

● |

|

Mixed biomass and waste:

Small-scale biomass < 50 MWe |

Tariff 2004 5.5 8.2 |

Tariff 2005 2.9 7 9.7 |

|

Poland |

|

● |

Not yet enforced |

||

|

Portugal |

● |

|

Tariffs (€ cents/kWh)

Wood Biomass (residual)

|

year 2005 7.2 7.2 7.1 7.2 |

new tariff 10.5 10 10 7.2 |

|

Slovenia |

● |

|

Biomass up to 1

MW: 6.98 €c/kWh; |

||

|

Slovakia |

|

|

--- |

||

|

Spain |

● |

|

RES producers may choose between a fixed preferential tariff or a (variable) premium price on top of the market price. Investment support is also provided. Tariffs are specified for plants 50MW. |

||

|

Year 2003 (€ cents/kWh)

|

premium price 3.32 2.51 |

feed-in tariff 6.85 6.05 |

|||

|

Sweden |

|

● |

Certificates prices will be settled by supply and demand. Forecasts show expected prices in the range of 1.3 – 1.6 € cents/kWh for certificates traded. |

||

|

United Kingdom |

|

● |

Green certificate system: the non-compliance ‘buy-out’ price for 2003-2004 is set at approx 4.5 € cents/kWh (buy- out price will be annually adjusted in line with the retail

price index) from the climate change levy on electricity of approx. 0.63 € cents/kWh) |

||

● = deployed promotion instrument; ○ = introduction is planned; 1

only in the Flanders region and only for photo-voltaic; 2 up to April

2005, the value of green certificates has been established by the GRTN, which

could also issue uncovered green certificates (with no counter-value of

renewable energy production) in order to prevent potential system malfunctions

in the initial phase of the market due to considerable demand and insufficient

availability of green certificates. Thus, in the first phase, the maximum price

of a certificate has been equal to the value of those issued by the GRTN. The

sale price of the green certificates held by the GRTN was 8.24 € cents /kWh in

2003, 9.74 € cents /kWh in 2004; 3 Primary biomass: that is used

directly from nature; the clearest examples are the energy crops, the forest and

the agricultural residues (pruning, straws...). Secondary biomass, still being

matter of biological origin, is the result of transformation processes made by

men: residues of wood industry, slurry and other animal residues, organic waste,

etc.

3.2 Standardisation of biofuels

Standardisation of biofuels is an important factor to foster the development

of the market of biomass for energy.

Bioenergy can be produced from resources of different origin and chemical

composition. These can be classified by their origin in the following broad

areas:

» Agricultural products (such as energy crops) and

residues (such as straw and olive stones from the agro-food industry).

» Forestry

products (such as wood from thinnings, short rotation forestry) and residues (such

as tops and branches left in the forest) and also residues, wastes, products and

by-products from forest-based industries and operations such as bark, sawdust

and fibre sludge

» Waste

streams generated by the consumer society (such as sorted biodegradable

fractions of municipal and industrial solid waste and sludge).

Solid biofuels and/or dedicated energy crops may contain substances that can

create significant pollution if used in inappropriate systems. Examples are

chlorine in straw (from fertilisation with potassium chloride) and forest

products from coastal locations (sea spray), cadmium in energy crops like

willows (natural Cd in the soil is effectively taken up by the crop) or heavy

metals. Biofuels with a “natural” content of chlorine may produce dioxins during

thermo-chemical conversion and can show similarities with fuels derived from

several waste streams. With this knowledge about biofuels, it is extremely

important to identify and define different properties, standardise the accepted

levels and have the right methods and tools to measure these properties.

Traditionally biofuels have been used in the form of fuel-wood for heating and

cooking in households. The forest-based industries like the sawmills and the

pulp and paper industries have always used residues such as bark, sawdust,

shavings, black liquor and fibre-products for in-house energy production.

As a result of national energy policies aiming at sustainable development,

biofuels are traded between producers and users. An international trade has been

developed between the EU countries and also with countries outside the EU. At

present, the international trade inside the EU has reached almost 1 Mtoe/year.

The trade covers products like wood chips, wood pellets, wood-logs and

by-products from sawmills.

The trade of biofuels for energy production is under development and the market

is increasing rapidly at the moment. A major problem for a dynamic and

sustainable market is that the quality of the traded biofuels varies extremely

among the various producers. The consequence is that the users are reluctant to

buy fuels when the quality and composition can not be specified and the

manufacturers of equipment do not guarantee their equipment for biofuels that do

not follow a specification.

The absence of European standards is a major barrier to develop the market for

solid biofuels. A market which is necessary for the European Union to reach its

targets for the deployment of bioenergy.

Standardisation of solid biofuels will help to regulate the market and to

provide confidence to fuel producers and fuel users. Standards on solid biofuels

with respect to quality and properties will make it possible to find the optimum

utilisation of different biofuels with respect to protecting the environment. In

addition, standards on solid biofuels will improve the efficiency of biomass

utilisation because the users will be able to procure fuels of a quality

corresponding to the specifications of their equipment.

3.2.1 Mandate to European Committee for Standardization - CEN

Based on the above issues, the European Commission proposed a mandate to CEN for

the elaboration of standards in the field of solid biofuels.

The Mandate (M 298, European Commission, 2000) was assigned taking into

consideration that:

1. waste is defined in Directive 75/442/EEC on waste,

2. incineration of municipal waste is regulated by Directives 89/369/EEC and

89/429/EEC for new and existing municipal incineration plants, respectively

3. the European Commission examined in the Directive 75/442/EEC under which

conditions a waste ceases to be a waste and becomes a product

In the Mandate it is underlined that wastes or products not originating from the

sources in the list below are explicitly excluded from this mandate:

»

Products from agriculture and

forestry

»

Vegetable waste from

agriculture and forestry,

»

Vegetable waste from the food

processing industry,

»

Wood waste, with the exception

of

o wood

waste that may contain halogenated organic compounds or heavy metals as a result

of treatment;

o treated wood originating from building and demolition waste

» Cork waste

Description of the mandate

The Commission assigned to CEN to produce a coherent set of European

standards for solid biofuels with the aim of satisfying the requirements

mentioned above, namely the creation of a stable market for solid biofuels and

for the related equipment.

In CEN Technical Committee 335 – Solid Biofuels, the foreseen standards are

organised under such a structure that they would provide adequate and clear

delineation among the various types of fuels, their origin and their fitness for

use in specific applications19. The standards structure should give the market

and the legislative authorities the possibility to distinguish between renewable

and fossil fuels. The standards should define sampling and measuring procedures

for those pollutants and impurities that are expected to be present in the

biofuels. This is allowing regulatory authorities and end users to assess the

technical and environmental aspects of solid biofuels combustion.

Standards

More in detail the required standards refer, among the others, to:

- terminology, definitions and descriptions

- fuel specifications and classes

- fuel quality assurance

- sampling, sample preparation, preparing sampling plans and sampling

certificates

- bulk density, particle density

- content of volatile matter

- ash melting behaviour

- particle size distribution

- density of pellets and briquettes

- durability, mechanical durability of pellets and briquettes

- moisture content

- ash content

- calorific value

- oxygen (O) content

- carbon, hydrogen and nitrogen content

- sulphur and chlorine content

- water soluble content of chloride, sodium and potassium

- major elements content (Al, Si, K, Na, Ca, Mg, Fe, P and Ti)

- minor elements content (As, Ba, Be, Cd, Co, Cr, Cu, Hg, Mo, Mn, Ni, Pb, Se,

Te, V and Zn)

3.3 Agricultural and forestry policies

3.3.1 Agriculture

As explained in previous sections, Agriculture and Forestry are the main

sectors-providers of biomass. In these contexts, energy use competes with other

uses (food, feed).

For instance, there are crops like oil-plants (rapeseed, sunflower), roots and

beets (for alcoholfuels), cellulose plants (cereales, high grasses, trees) that

may have an energy destination20. Besides, farmers or transformers produce offals

from plant use, but also from animals (slaughter offals like fat and meals). And

the gasification of manure is possible.

Recently, CAP reform has increased market orientation of agriculture. Better

opportunities are then provided for farmers to adapt production to increasing

demand for biomass. With the new Regulation (1782/200321 ), EU’s

farmers will get a single payment per farm and they can, in principle, produce

whatever they want. Also energy crops grown on set-aside land will receive

payments under the new Single Payment Scheme. Energy crops grown on non

set-aside22 land will receive payments under the new Single Payment

Scheme plus the new energy crops payment, consisting of € 45/ha. This applies

for a maximum area of 1.500.000 ha. The aid will only be granted in respect of

areas whose production is covered by a contract between the farmer and the

processing industry except where the processing is undertaken by the farmer on

the holding. All crops (except sugar beet) are eligible for support, including

some multi-annual. However, the system is not applicable within simplified

premium system in new Member States

The results of the first year (2004) of application of energy crops support

(45€/ha for a maximum area of 1.500.000 ha) are presented hereafter23:

- EU 25: around 300.000 ha (of 1.5 millions)

- France 129.000 ha

- Germany 109.000 ha

- UK 30.000 ha

- Sweden 13.600 ha

- Spain 7.000 ha

- Denmark 4.900 ha

- Austria 4.100 ha

- Finland 3.500 ha

- Slovenia 300 ha

- Less than 300 ha: Irland, Netherlands, Belgium, Italy, Greece, Portugal

3.3.2 Forestry

Since the publication by FAO and UN/ECE of the Temperate and Boreal Forest

Resources Assessment in 2000 ([TBFRA 2000]), a full set of comparable data on

forest cover and forest cover change is now available for Europe, CIS24,

North America, Australia, Japan and New Zealand. All figures that follow are

based on TBFRA 2000. They are only applicable to forests and not to “other

wooded land” (OWL)25.

EU forests cover approximately 113 million hectares, or 36 percent of the land

area, while EU OWL accounts for another 23 Mha (TBFRA 2000). Between the

countries exist large differences in forest cover, ranging from 9 (Ireland) to

over 72 percent (Finland).

The forest area in the ten new EU Member States covers 23.5 million hectares, or

33 percent of their land area. Poland is most rich in forests – in absolute

terms (9 million hectares). In relative terms the forest cover ranges from 1

(Malta) to 55 (Slovenia) percent. The new EU Member States have a share of 17

percent of forests in the European Union of the twenty-five (EU25).

EU forests are expanding: in 1990-2000 the area under forest cover in Europe has

increased by 3.40 M ha, i.e. an annual increase in area of 340.000 ha (TBFRA

2000, based on country sources for different multi-year periods around 1995).

50% of this increase derives from new plantations, while 50% originates from

natural expansion of the forests.

The ratio between yearly fellings and net annual increments is, on average,

about 60% (in EU 15), 302 and 483 million cubic meters, respectively. In some

Member States, however, this ratio is below 40%. In the new Member States the

ratio is slightly higher, i.e. 64.8 percent (125 million cubic meters of net

annual increment and 81 million cubic meters of annual fellings).

65-70% of forests are in private ownership in EU 15 whereas 25% are privately

owned in New EU Member States. 75% in New EU Member States is state owned while

only 30-35 % in the EU15.

Overall in the European Union, forest holdings are rather small, especially

compared to agriculture lands holdings. In many of the Central and Eastern New

EU Member States countries up to almost 90 percent of private forest owners will

own forest of less than 3 ha in size (MCPFE, 2003). This poses specific problems

for a cost-effective and a sustainable management of the forest resources.

Transition to a market economy and the simultaneous emergence of private forest

ownership will need considerable change of the foundations of forest policy

formulation and implementation.

Aspects that are emerging in the last years are limited market for small sized

wood (because of thinning delay) and availability of land due to CAP reform (in

upland areas)

Forestry biomass supply scenario is presented in Table 6.

Measures that can be thought of to successfully accomplish reported targets are:

- Classic afforestation (no result expected before 2010 )

- Fast growing plantations ( + 21 Mm³/y by 2010, much more in medium term)

- Dedicated energy crops (very effective in short term but few examples > 15-20

m³/ha/y)

- Adapting management in existing forests to raise output:

o 75 %

util. rate >100 Mm³/y extra output

o removing more logging residues

o facilitating pre-commercial thinnings

- Changes in use of small roundwood (possible competition for resource > higher

prices / effects on global market positions )

- Land use changes: (Long Term option)

o

restoring degraded forest (+ 100 Mm³/y)

o making OWL productive ( + 8 Mm³/y)

- Production Forestry Policy: + 90 Mm³/y (long term)

o 25 %

nature conservation

o 50 % multifunctional

o 25 % production only

Table 6: Expected biomass inputs for RES E + RES H / 2010. Source: DG

Environment.

|

|

Total Biomass Demand |

Covered by agric. sector |

Covered by wood |

Of which wood residues |

Of which forest biomass |

Total forest biomass demand |

|

|

Mm3/a |

|

|

|

|

Mm3/a |

|

RES E in 2002 |

38 |

8% |

92% |

77% |

23% |

8 |

|

RES H in 2002 |

103 |

1% |

99% |

88% |

12% |

12 |

|

Current total |

142 |

4 |

138 |

117 |

21 |

21 |

|

Share |

100% |

3% |

97% |

82% |

15% |

15% |

|

|

|

|

|

|

|

|

|

BAU Scenario |

|

|

|

|

|

|

|

RES E in 2010 |

81 |

27% |

73% |

75% |

25% |

15 |

|

RES H in 2010 |

114 |

5% |

95% |

87% |

13% |

14 |

|

Total |

214 |

28 |

186 |

151 |

35 |

35 |

|

Share |

100% |

13% |

87% |

71% |

16% |

16% |

|

|

|

|

|

|

|

|

|

VP Scenario |

|

|

|

|

|

|

|

RES E in 2010 |

180 |

45% |

55% |

58% |

42% |

41 |

|

RES H in 2010 |

133 |

12% |

88% |

82% |

18% |

21 |

|

Total |

313 |

97 |

216 |

154 |

62 |

62 |

|

Share |

100% |

31% |

69% |

49% |

20% |

20% |

BAU= Business As Usual

VP = Voluntary Policy

Finally, it must be emphasized that forestry biomass has to be somehow

integrated in energy policies, by, among different possibilities:

• raising incentives for afforestation, thinning

• favourable tax regimes for biomass energy

• increasing co-operation among forest owners

• designation of biomass production areas

• specific support schemes for energy crops /coppice.

3.4 Authorisation procedures, waste definition, co-firing

European Policies and Legislation on renewable energy takes into account the

often difficult process of authorisation that power plants may face26.

As regards biomass, problems in the authorization procedures are usually

associated with the fact that it is not always possible to draw a clear

distinction between biomass and waste.

Waste Incineration Directive (2000/76/EC) only excludes from its scope plants

which utilize some typologies of forestry, agriculture and industry residues:

(a) Plants treating only the following wastes:

(i) vegetable waste from agriculture and forestry,

(ii) vegetable waste from the food processing industry, if the heat generated is

recovered,

(iii) fibrous vegetable waste from virgin pulp production and from production of

paper from pulp, if it is co-incinerated at the place of production and the heat

generated is recovered,

(iv) wood waste with the exception of wood waste which may contain halogenated

organic compounds or heavy metals as a result of treatment with wood

preservatives or coating, and which includes in particular such wood waste

originating from construction and demolition waste,

(v) cork waste

Other kinds of biomass (e.g. poultry litter, manure, etc.), on the contrary,

are only utilisable in plants that are formally classified and authorised as

incinerators, which, often, constitutes an important barrier to the development

of these plants.

Besides, different kind of residues (from forestry or agriculture) are, in

principle, classified as waste before they enter the biomass plant and so they

have to be managed according to waste legislation, which entails a specific

authorization and specific competences in the field of waste management for the

power generation company that is running the biomass plant.

Related to this issue, the question of co-firing is to be considered. Co-firing

means that biomass is not the only fuel utilized in the power plant. If the

other fuel is waste derived fuel, then an authorisation for incineration will be

required and incentives (feed-in tariffs or green certificates) will, in

principle, be only assigned to biomass fraction27. Also in the case

of co-combustion with coal, incentives will only be assigned to the biomass

fraction. It is also possible that a certain threshold is defined as minimum

percentage of biomass utilisation.

Incentives to biomass mixed to waste or coal may be lower than those guaranteed

to pure biomass generation, as reported in Table 5, for some EU countries.

Besides, co-combustion plants may be excluded by other complementary measures to

promote green electricity, like fiscal exemptions or guarantees of origin of

renewable electricity. For instance, in the Netherlands, co-combustion do not

qualify for exemption from REB (regulating energy) tax for green electricity

products purchase and REB production subsidy and therefore do not qualify also

for the receipt of green labels.

In UK, co-firing with biomass that attracts ROCs (Renewable Obligation

Certificates) will be subject to increasing restrictions:

- any biomass can be co-fired until 31 March 2009 with no minimum percentage of

energy crops;

- at least 25% of co-fired biomass must be energy crops from 1 April 2009 until

31 March 2010;

- at least 50% of co-fired biomass must be energy crops from 1 April 2010 until

31 March 2011;

- at least 75% of co-fired biomass must be energy crops from 1 April 2011 until

31 March 2016.

Co-firing ceases to be eligible for ROCs after this date.

3.5 Promotion of heat and co-generation

As underlined before, utilisation of biomass for heat production is deemed

to be an important part of bio-energy generation.

Residential and tertiary energy consumption absorbs an important share of EU

final energy uses. About two thirds of this consumption is associated with

heating. So, as regards residential users, there seems to be a possibility of

bioenergy expansion, especially to substitute electricity with biomass and to

provide supply to new users.

Besides, in EU 25 there is almost 50% of steam self production out of total

steam generations. In this sector bioenergy could play an important role in the

future, even only for industries where bioenergy is generated as a by-product

(e.g. in the production of woody products, in the agro-food industry, etc.).

As regards distributed heating, it can be identified a consistent potential in

EU new Member States (NMS), where there is a larger opportunity (with respect to,

e.g., utilisable land) for fossil fuel (coal and oil) substitution with

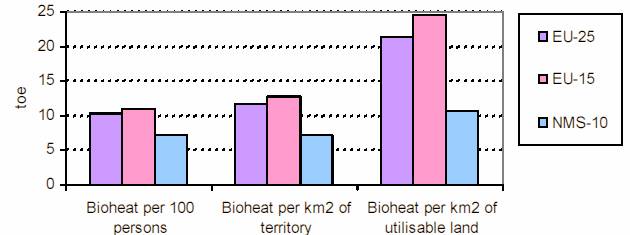

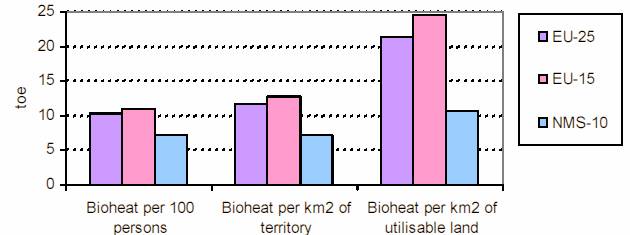

renewables (biomass) than in EU-15 (Figure 3).

Figure 3: Bioheat generation in EU States, with respect to persons, territory

and utilisable land.

Source: European Biomass Action Plan, External Stakeholders Meeting, 4 March

2005.

Heat-only or electricity-only generation from biomass make already a positive

contribution to European renewable energy, security of supply and Kyoto targets.

For a number of reasons, they may sometimes be the only viable option and in

these cases the construction of heat-only or electricity only installations is

currently promoted in EU Member States.

Nonetheless, the European Cogeneration Directive requires to analyse heat

demands that are suitable for cogeneration from renewables, with a particular

view to cogeneration from biomass.

Amongst other things, this analysis should consider "the type of fuels that are

likely to be used to realise the cogeneration potentials, including specific

considerations on the potential for increasing the use of renewable energy

sources in the national heat markets via cogeneration" (Annex IV of the

Directive).

Two good examples of how an effective biomass co-generation promotion could be

achieved are given by Germany and the Walloon Region in Belgium.

- In Germany, cogeneration installations obtain an additional € 0.02 per

kilowatt-hour of electricity fed into the electricity network (as it is

observable in Table 8), if they burn gas produced from biomass

gasification. This bonus is in addition to the usual remuneration.

- In Belgium, the Walloon Government has introduced a successful "green

electricity certificates" system, under which the use of renewable energy

sources in a cogeneration process is eligible for twice the amount of green

certificates compared with heat-only or electricity-only generation from

renewables.

Two further EC initiatives are contributing to promote heat and co-generation

from renewable sources and especially from biomass:

- the Directive on the energy performance of buildings (2002/91/EC), supporting,

among others, the application of renewable heating applications.

- The Directive on the taxation of energy products and electricity (2003/96/EC),

specifying minimum tax rates and permitting tax exemptions for energy products

and electricity from renewable sources.

An important aspect of bio-heat promotion concerns authorisations for the use of

bio-fuels in civil and residential boilers, a problem already mentioned in the

report. It is often the case that national laws have not yet drawn a clear

distinction between biomass and waste materials, so that for administrative

authorities at local level it is not easy to understand if a biomass residue can

be handled and utilised in residential boilers in a safe and environmentally

sound manner.

Pellets

Compressed wood or other biomass in form of pellets have been studied

throughout Europe and promoted to facilitate the use of biomass at residential

level. However, while the markets for utilising wood pellets in the northern

European countries are well established and still expanding, the markets in

southern Europa are still in their virgin state. In this sense, the success of

wood pellets in European Countries such as Austria, Denmark and Sweden, has yet

to be replicated elsewhere. In Southern European countries, the lack of

available wood waste means that pellets from agricultural residues ("agri-pellets")

are the most promising solution.

In the vast majority of the European countries, there are few or no laws written

specifically for pellets. Often these come under the jurisdiction of only very

general biomass laws.

Presently only few European countries like Austria, Sweden and Germany have

official standards specifically for compacted biomass fuels. Other countries

with significant pellet markets like Denmark and Finland have decided to wait

for the completion of a common European pellet standard. Comprehensive work has

been done on defining standard methods for analysing and classifying pellets and

are defined in the report of CEN/TC 14961. In Table 7 the most commonly

used standards together with the new CEN classification system of pellets are

listed.

Table 7: Standards for pellets.

|

COUNTRY |

STANDARD |

|

Austria |

ÖNORM M1735 (briquettes and pellets) |

|

Sweden |

SS 187120 (pellets) and SS 187121 (briquettes) |

|

Germany |

DIN 51731 (briquettes and pellets) |

|

European Union – CEN TC 335 'Solid Biofuels' |

CEN/TS 14961 "Annex A" Examples of specifications for high quality classes of solid biofuels recommended for household usage |

4 COUNTRY CASES OF RENEWABLE/BIOMASS ENERGY PROMOTION

In this chapter some exemplars of recently adopted policies and regulations

to promote renewable, and especially biomass, energy are presented. These refer

to different EU Member States (Germany, UK, Italy, Belgium) that have planned

and are planning to exploit biomass for energy generation and have thus defined

specific mechanisms to support and encourage this exploitation.

4.1 Revisions of feed-in tariffs for biomass electricity – Germany

In Germany, in 2000, the Renewable Energy Sources Act ("Erneuerbare

Energien-Gesetz", EEG-2000) replaced the Electricity Feed-in Act28.

As a consequence of the developments described above, under the new EEG, feed-in

prices were no longer linked to electricity retail prices, but fixed for 20

years. The cap on the share of electricity from RES was abolished. Instead, the

total amount of feed-in reimbursements were distributed evenly among all high

voltage grid operators and equally among all electricity consumers there.

Furthermore, the feed-in tariffs for some RES such as wind were planned to be

decreased annually for plants installed after 1st January 2002.

The EEG guaranteed preferential prices with respect to the favoured group (the

RES producers), but with the special feature of financing by the end-users of

electricity. The incentive was a positive sanction in the form of guaranteed

payments for the total amount of electricity produced. In the EEG, two important

and innovative features were implemented:

• Decrease of tariffs - supporting technology learning: from 2002 on, new

installations receive lower tariffs. From 2003 on, new installations of these

types receive tariffs lowered at the same rate, and so on for the following

years. This is to retain the incentive for manufacturers to systematically

reduce production costs and to offer more efficient products every year. The

rate of decrease is based on the empirically derived progress ratios (from the

theory of technology learning) for the different technologies.

• Stepped nature of tariffs - supporting financial efficiency: the tariffs for

the different technologies defined in the act are determined based on the yield

/ generation costs of each particular plant. This feature is especially

important for wind energy but applies to other RES as well, e.g. to biomass with

respect to plant size and fuel type. Investors in wind power at sites above a

reference value receive a substantially lower feed-in tariff starting 5 years

after installation. At sites with below average wind yield, the time period for

the higher feed-in tariff is prolonged. This feature leads to a lower level of

promotion at sites with very good wind conditions and higher promotion levels

under less advantageous wind conditions. Therefore the price of the tariff

mirrors the cost resource curve of the technology. This results in a reduction

of the producer profit and therefore in lower transfer costs for society.

Furthermore, the feed-in tariffs are reviewed every two years according to the

new act, first in 2007 and then every four years in the light of technological

and price developments; feed-in tariffs for new sites installed at a later point

in time can be modified accordingly. For every single site, the date of

expiration is twenty years after the date of installation.

Current legislation (amended EEG / August 2004)

In year 2004, a detailed target for the share of renewables in electricity

production of at least 12.5 % (2010) and at least 20 % (2020) was set in order

to underpin the importance of long-term stability of the German RES-E policy.

The revised act intends to improve the integration of RES plants into the

electricity system and provides incentives for operators of RES plants and grid

operators to participate in a power management of RES facilities. Furthermore

the priority right for access and connection to the grid has been enforced.

In the case of bioenergy, the tariffs have been adjusted to increase market

competitiveness, in particular for small-scale biomass plants. Furthermore,

special incentives are provided for the use of innovative technologies, plant/crop-based

renewable resources and CHP.

Table 8: Current tariff structure of the EEG for Biomass, from August 2004.

|

Type of biomass |

General |

Renewable resources [1] |

CHP |

CHP + innovative tech. [2] |

Waste wood from 1.7.2006 |

|

|

Plant dimension |

€/MWh |

Decrease* | ||||

|

< 150 kW |

115 |

175 |

135 |

155 |

39 |

1.5% |

|

150 -500 kW |

99 |

159 |

119 |

139 |

||

|

500 kW - 5 MW |

89 |

129 (114 for wood) |

109 |

129 |

||

|

5 MW - 20 MW |

84 |

84 |

104 |

104 |

||

[1] a) from plants or parts of plants which have originated from agricultural,

silvicultural or horticultural operations or during landscaping activities and

which have not been treated or modified in any way other than for harvesting,

conservation or use in the biomass plant; b) from manure within the meaning of

Regulation (EC) No 1774/2002 of the European Parliament and of the Council, as

amended by Commission Regulation (EC) No 808/2003, or from vinasse generated at

an agricultural distillery pursuant to Article 25 of the Spirits Monopoly Act as

promulgated in the Federal Law Gazette Part III No. 612-7, last amended by

Article 2 of the Act of 23 December 2003 (BGBl. I p. 2924), if that vinasse is

not subject to any other recovery requirements pursuant to Article 25(2) No. 3

or paragraph (3) No. 3 of that Article of the Spirits Monopoly Act or c) from

both substance categories.

[2] "……. if the biomass is converted by thermochemical gasification or dry

fermentation and if the gas used for power generation is processed to reach the

quality of natural gas or if the electricity is produced by fuel cells, gas

turbines, steam engines, organic Rankine cycles, multi-fuel plants, especially

Kalina cycles, or stirling engines……".

* Reduction of tariffs every year for new installed systems.

4.2 Recent advances in biomass energy promotion – Italy: tariffs for

small-scale plants (< 1MWe) and regulation for the use of biofuels in industrial

& civil boilers

In Italy some recently issued decrees, concerning energy sector, fuels

regulation and specifically renewable electricity are contributing to enhance

the diffusion of renewable energy projects, especially biomass.

4.2.1 Tariffs for small-scale renewable power plants

Law 239/04 (on Energy Sector) and Decree 387/03 (for application of

Directive 2001/77/EC on renewable electricity) have introduced concessions and

inventives for small-scale renewable or co-generative29 power plants

(< 1 MWe, also called "distributed generation"). Economic conditions for

purchase of renewable electricity by GRTN (National Transmission Network.

Administrator are presented hereafter (Table 9)

Table 9: Economic remunerations for renewable electricity (Green Certificates

not considered here)

|

Electricity produced by |

Remuneration |

|

< 10 MWe (programmable or not, any date of entering into operation |

Selling price to Distribution Companies, guaranteed miminum price for first and second million of kWh yearly generated by plants < 1 MWe |

|

> 10 MWe non-programmable, put into operation after 1 April 1999*) |

Selling price to Distribution Companies |

|

> 10 MWe non-programmable, put into operation before 1 April 1999*) |

Selling price to Distribution Companies (No Green Certificates) |

|

Hybrid plants < 10 MWe |

Selling price to Distribution Companies for kWh qualified as renewable; for other kWh: selling price to Distribution Companies if plant is cogenerative, otherwise unitary variable cost guaranteed for electricity generated by thermoelectric p lants utilising commercial fossil fuels |

|

> 10 MWe Programmable and hybrid plants |

Price is determined by bids in the electricity market |

* Date of beginning of Green Certificates Scheme

Selling prices to Distribution Companies is determined by Acquirente Unico

(Single Buyer30) in relation to different rate periods or as

undifferentiated prices (average in the period considered). Recently determined

selling prices, together with rate periods for year 2005, are reported in

Table 10.

Table 10: Selling prices to Distribution Companies. Figures for year 2004 and

January 2005

| 2004 | 2005 | |||||||||

| april | May | june | july | august | septemb | octob | novemb | decemb | january | |

| € cents/ kWh | ||||||||||

|

F1 |

10,10 | 10,9 | 10,1 | 12,6 | 16,1 | 13,4 | ||||

|

F2 |

6,6 | 6,7 | 7,4 | 7,1 | 6,6 | 6,6 | 6,6 | 6,6 | 5,6 | 9,1 |

|

F3 |

6,4 | 6,0 | 3,8 | 4,7 | 6,0 | 6,2 | 6,2 | 5,0 | 4,5 | 7,2 |

|

F4 |

3,8 | 3,9 | 4,3 | 4,5 | 4,5 | 4,0 | 3,5 | 3,6 | 4,0 | 4,2 |

| Rate periods 2005 (DELIBERA AEEG 235/04) | ||||||||||||||||||||||||

| MONDAY-FRIDAY | ||||||||||||||||||||||||

| Hours | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 1-9 January | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 |

| 10 jan-11 mar | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F2 | F2 | F2 | F2 | F2 | F3 | F2 | F2 | F2 | F2 | F2 | F2 | F2 | F3 | F4 | F4 | F4 |

| 14 mar-29 apr | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F3 | F2 | F2 | F2 | F3 | F3 | F3 | F3 | F3 | F3 | F3 | F3 | F3 | F3 | F4 | F4 | F4 |

| 2-31 may | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F3 | F2 | F2 | F2 | F2 | F3 | F2 | F2 | F2 | F2 | F3 | F3 | F3 | F3 | F4 | F4 | F4 |

| 6-30 june | F4 | F4 | F4 | F4 | F4 | F4 | F3 | F2 | F1 | F1 | F1 | F1 | F2 | F2 | F1 | F1 | F1 | F2 | F2 | F2 | F2 | F2 | F4 | F4 |

| 1-29 july | F4 | F4 | F4 | F4 | F4 | F4 | F3 | F2 | F1 | F1 | F1 | F1 | F2 | F2 | F1 | F1 | F1 | F2 | F2 | F2 | F2 | F2 | F4 | F4 |

| 1-5 august | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F3 | F2 | F2 | F2 | F2 | F3 | F2 | F2 | F2 | F2 | F3 | F3 | F3 | F3 | F4 | F4 | F4 |

| 6-21 august | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 |

| 22 aug-16 sept | F4 | F4 | F4 | F4 | F4 | F4 |

F3

|

F2 | F2 | F1 | F1 | F1 | F2 | F2 | F2 | F1 | F1 | F2 | F2 | F2 | F2 | F3 | F4 | F4 |

| 19 sept-18 nov | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F3 | F2 | F2 | F2 | F3 | F3 | F3 | F3 | F2 | F2 | F2 | F2 | F3 | F3 | F4 | F4 | F4 |

| 21 nov-7 dec | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F3 | F2 | F2 | F2 | F2 | F3 | F3 | F2 | F2 | F1 | F1 | F2 | F2 | F3 | F4 | F4 | F4 |

| 12-23 december | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F3 | F2 | F1 | F1 | F2 | F3 | F3 | F2 | F2 | F1 | F1 | F2 | F2 | F3 | F4 | F4 | F4 |

| 24-31 december | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 |

| SATURDAY-SUNDAYAND WEEK HOLIDAYS (*) | ||||||||||||||||||||||||

| 1 gen-31 dic | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 | F4 |

| (*) 1-6 january, easter monday, 25 april, 1 may, 2-3 june, 15 august, 31 october, 1 november, 8, 9, 25 and 26 december | ||||||||||||||||||||||||

As mentioned in Table 9, for renewable power plant < 1 MWe (including waste to

power plants and excluding hybrid plants), there are minimum guaranteed prices

for the first two millions of kWh generated, which are defined for different

brackets:

- For first 500.000 kWh (generated per year): 95 € / MWh;

- From over 500.000 to 1.000.000 kWh: 80 € / MWh;

- From over 1.000.000 to 2.000.000 kWh: 70 € / MWh;

- Over 2.000.000 kWh: selling price to distribution companies (per rate period

or undifferentiated)31.

4.2.2 Regulation for the use of biofuels in industrial and civil boilers

The Decree of the President of the Council of Ministers 8th March 2002 (DPCM

08/03/2002) establishes the characteristics of fuels for industrial32 and civil

combustion plants, as well as some technical plant specification.

This decree includes a specific section for "Biomass", which has emerged as very

important to regulate and also to promote the use of biofuels in energy (electricity

and heat) generation.

Typologies of biomass enumerated in this section are:

(a) Vegetal material deriving from dedicated crops;

(b) Vegetal material deriving from exclusively mechanical treatment of

agricultural non-dedicated crops;

(c) Vegetal material deriving from silvicultural interventions, forestry

maintenance and pruning;

(d) Vegetal material deriving from exclusively mechanical treatment of virgin

wood and consisting of barks, sawdust, shavings, chips, edgings, billets,

granulated and rejected virgin wood, granulated and rejected virgin cork,

non-contaminated billets;

(e) Vegetal material deriving from exclusively mechanical treatment of

agricultural products.

In the decree, conditions for the utilisation of biomass in combustion plants

are given, together with emission limits, depending on plant dimensions (Tables

11 and 12).

Table 11: DPCM 08/03/2002, Emissions limits for Biomass combustion.

|

|

≥ 35 ÷ ≤ 150 kW |

> 0,15 ÷ ≤ 3 MW |

> 3 ÷ ≤ 6 MW |

> 6 ÷ ≤ 20 MW |

> 20 |

||

|

|

(mg/Nm3 , O2 @ 11%) |

||||||

|

Particulate matter |

200 |

100 |

30 |

30 |

30 |

10 |

|

|

TOC |

- |

- |

- |

30 |

20 |

10 |

|

|

CO |

- |

350 |

300 |

250 |

150 |

200 |

100 |

|

NOxi |

- |

500 |

500 |

400 |

300 |

400 |

200 |

|

SOxi |

- |

200 |

200 |

200 |

200 |

||

|

i Expressed as NO2 and SO2 respectively |

|||||||

|

|

|

Hourly average |

|

Daily average |

|

||

Table 12: Further controls required by DPCM 08/03/2002 to ensure, in normal

working conditions, respect of emissions limits.

|

|

1-3 MW |

3-6 MW |

6-20 MW |

> 20MW |

|

Fuel automatic feeling system |

MANDATORY |

|||

|

Continuous measurement in combustion chamber (T, O2) and automatic regulation of air/fuel |

|

MANDATORY |

||

|

Pilot burner |

|

|

MANDATORY |

|

|

Continuous measurement: T, CO, NOx, steam |

|

|

MANDATORY |

|

|

Continuous measurement: dust, TOC |

|

|

|

MANDATORY |

Recently, a revision of the decree has been necessary to explicitly include a

biomass material (olive pomace) which is subject to a non-mechanical treatment (process

with hexane) that, however, do not compromise an environmentally sound

utilisation in civil or industrial boilers33.

4.3 Introduction of Green Certificates for renewable electricity based on CO2 emissions – Walloon Region, Belgium

In Wallonia the green certificate system came into effect on October 1st 2002.

The quota for the first obligation period ending on 31 December 2003 was set at

3%. This percentage will increase by one point per year till 2007 – 4% in 2004,

5% in 2005, 6% in 2006 and 7% in 2007.

A Green Certificate is assigned for a given quantity of avoided CO2 emissions (1

GC = 456 kg CO2 avoided), compared with the best reference technologies34, and

through the use of:

- a renewable energy source (production of electricity)

- a cogeneration unit,

which means one green certificate per MWh for wind, small-hydro, biomass (in

principle) or solar PV but 3.3 MWh for a natural gas cogenerator and 6.2 MWh for

a fuel oil cogenerator.

Green certificates are valid for five years. Those suppliers which fail to reach

each quarter the annual quota are obliged to pay a fine per green certificate

missing (75 € till 30 june 2003 and 100 € thereafter). The amount of the fine

indicates the theoretical ceiling price of the certificates.

Thus, there is a Single Green Certificate mechanism for quality cogeneration and

electricity from renewable energy sources. This permits to have greater

liquidity of the Green Certificates’ market and the possibility to integrate

complex processes (different types of fuel, hybrid installations, renewable or

non renewable fuels, partially or fully combined with cogeneration, etc. ).

It also raises the need for a common denominator of CO2 saving.

As regards biomass, it can be noted that conventional CO2 emissions are

different for diverse categories of materials, as reported in Table 13.

Table 13: CO2 emissions coefficients of primary energy sources defined in

Wallonia GC scheme.

|

Energy Sources |

Conventional value (kg CO 2/MWhp) |

|